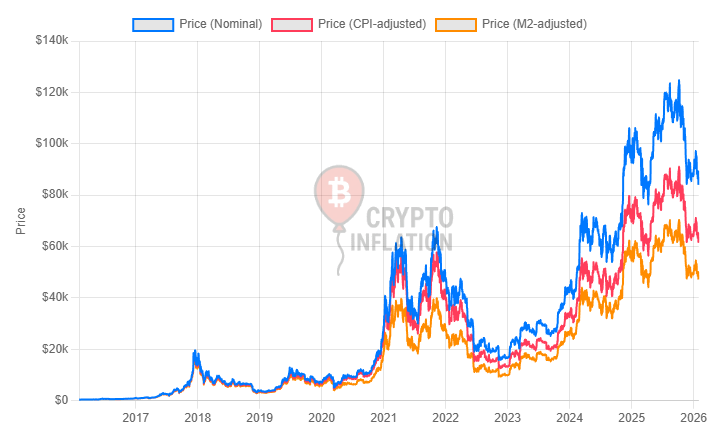

I though this one might be interesting: we've fetched the data from the U.S. Bureau of Labor Statistics and the FED and projected it onto the crypto prices. You can adjust the timeframe, switch the coin, change the base date and more. Feel free to try it out for yourself – https://www.cryptoinflation.eu/crypto-prices-adjusted-for-inflation-interactive-calculator/

How it works (in short): Adjusted price is just nominal price multiplied by a conversion factor derived from CPI or M2 changes over the same period (it is computed stepwise using YoY changes, and I forward-fill any missing/zero macro prints so the series flatlines instead of dropping to zero during gaps/shutdown weirdness).

by Adorable-Platypus-46

1 Comment

I don’t know if you’re the same guy who posted this last time, another uninformed individual , or some sort of crypto shill, but comparing a speculative asset price to currency circulation makes absolutely no sense.

Please in your own words explain what it means to adjust the price of an asset against monetary supply.