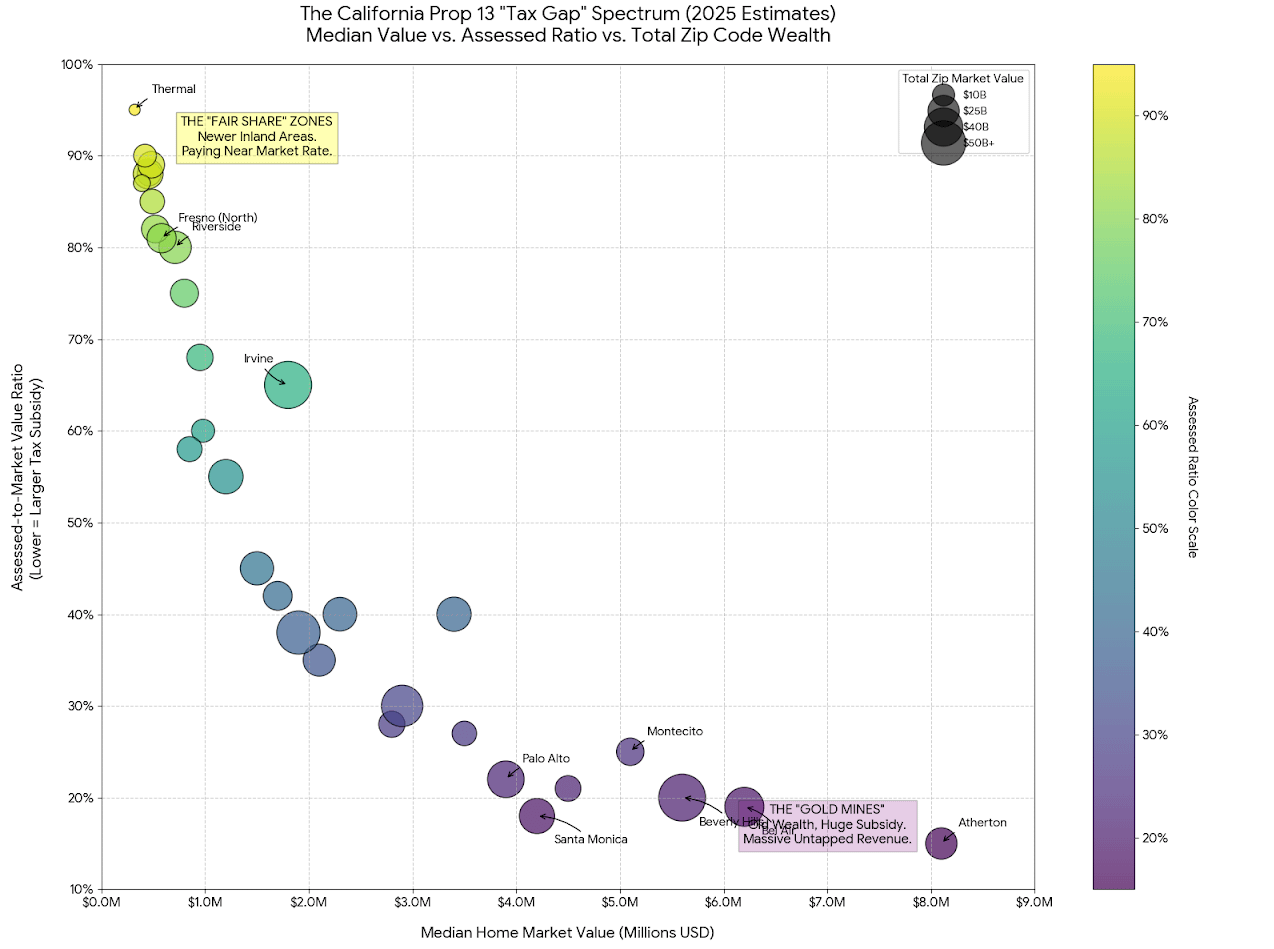

California Proposition 13 defenders say it allows seniors to live in their home without being priced out.

The reality is that it subsidizes the wealthiest people, in Atherton, Beverly Hills and Palo Alto, who probably have multiple homes anyway like billionaire VCs and tech execs

We could stop subsidizing those billionaires and cut property and income tax rates for everyone, if we trim prop 13 to just a means tested benefit for the primary residence

On top of that, it will make the housing market more liquid and fair, especially for first time home buyers.

by orijing

5 Comments

Is there a source for this?

If prop 13 was actually about seniors, it wouldn’t apply to commercial properties. The “helping seniors” is just a thin veneer to give a major tax cut to already wealthy people and entrenching their wealth while hampering the social mobility of any newer residents.

To be fair, to evaluate the “helping seniors” statement we would need some demographic data, like % of residents who are senior in each city.

In any case, a home being assessed at 20% of it’s market value is outrageous.

As somebody with a hosue in Atherton, I think my taxes should be higher. But to my mind, it makes more sense for it to come in the form of higher/more progressive income tax or even a wealth tax. Property taxes aren’t correllated enough with wealth dichotomies.

I know that this is spiteful, but I’d vote for a law if its only effect was hurting people who live in Atherton.