Data Sources:

• FRED – Federal Reserve Economic Data (https://fred.stlouisfed.org/)

• Series used: UNRATE, CPIAUCNS, FEDFUNDS

Tools:

• R (tidyverse, ggplot2) + FRED API

• Graphic layout in Affinity Designer

What the chart shows:

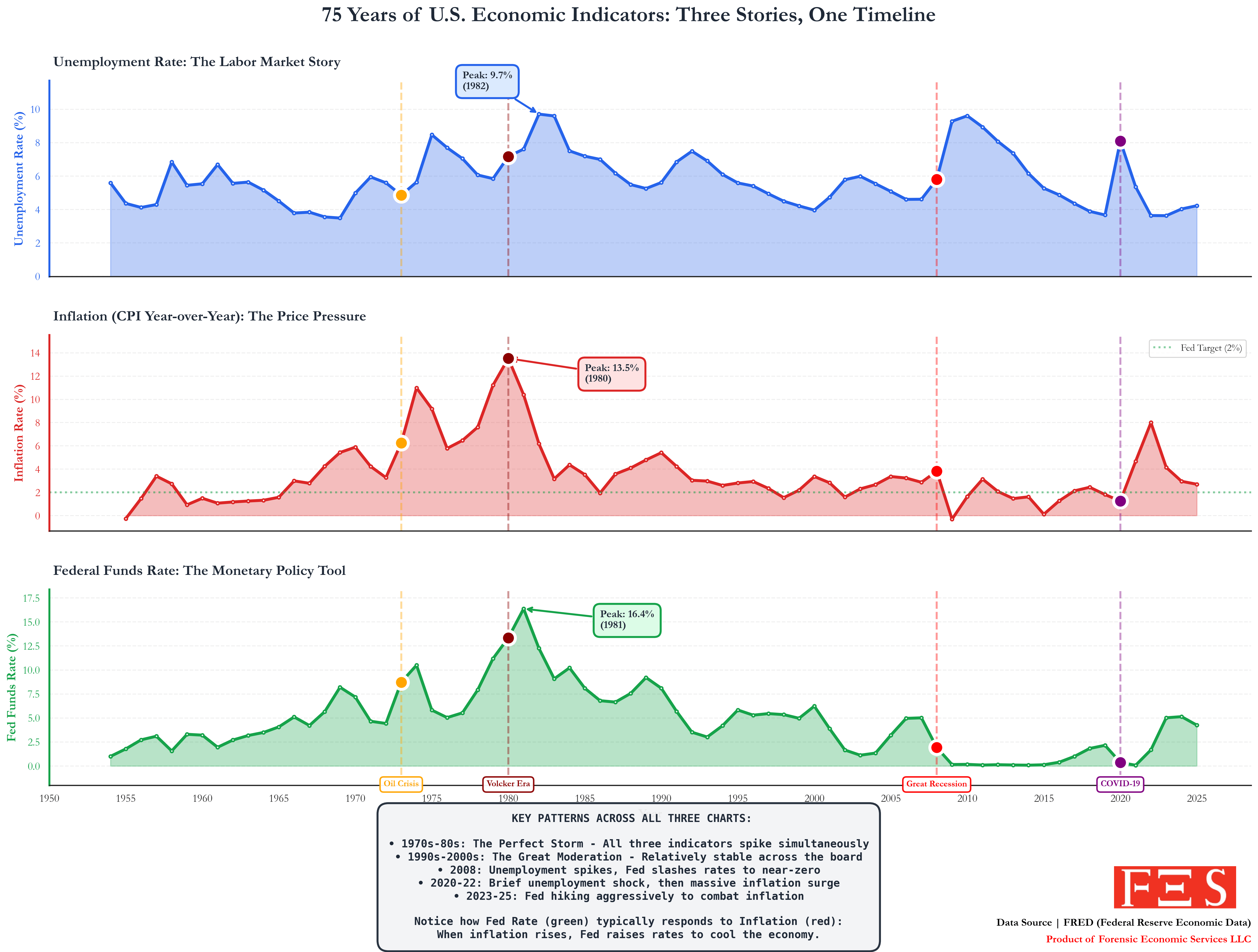

This is a 75-year timeline of three major U.S. economic indicators on one visual:

• Unemployment Rate (labor market conditions)

• Inflation (CPI, YoY%) (price pressure & purchasing power)

• Federal Funds Rate (monetary policy lever)

Plotted together, the relationship becomes clearer:

📌 1970s–1980s: A “perfect storm” — unemployment, inflation, and interest rates all spike simultaneously.

📌 1990s–2000s: A long stretch of relative stability — the "Great Moderation."

📌 2008: Unemployment spikes as the Fed slashes rates toward 0% to support the economy.

📌 2020-22: Rates drop to near-zero again, then increase aggressively to combat post-pandemic inflation.

Key pattern:

When inflation rises, the Fed often raises interest rates to slow the economy, which can lead to higher unemployment later — a feedback loop of policy vs. economic reality.

Made by: Forensic Economic Services LLC, rule703.com

(product credit only, not a solicitation)

by forensiceconomics