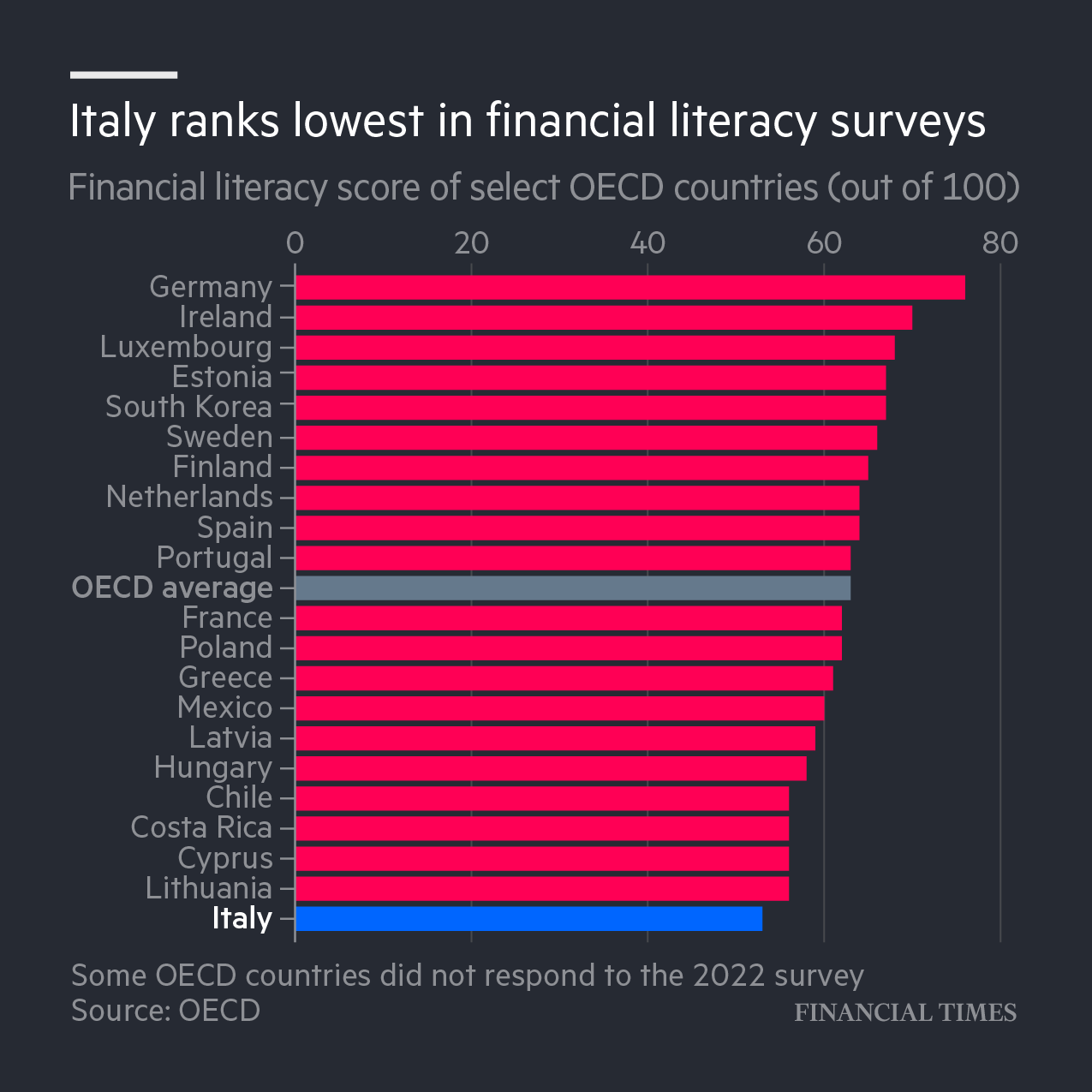

Italy has the least financially literate population among developed nations surveyed by the OECD. Fewer than four in 10 Italians can correctly answer questions about basic concepts like inflation, compound interest and risk diversification.

40% of Italians aged 18 to 34 never speak about money at home, and the same proportion feel uncomfortable discussing finances, according to a survey by Italy’s central bank.

'We come from a Catholic and Latin culture where money has a negative connotation, it’s associated with greed and avarice,' says Giovanna Paladino, founder and director of Turin's Museum of Saving. 'But understanding money as an end in itself is wrong. Money is a tool that allows us to realise personal and collective desires and projects.'

In Italy, as elsewhere, reticence about money translates into low levels of financial literacy — with negative consequences for individuals, as well as for society as a whole.

You can read the full story for free with your email, here: https://www.ft.com/content/066c0c98-ec47-4b51-9416-b2b2661ec942?segmentid=c50c86e4-586b-23ea-1ac1-7601c9c2476f

Source: OECD

Victoria – FT social team

by financialtimes

14 Comments

It’s interesting that Italy and Spain are so different, considering they are both heavily Catholic southern European countries with a reputation for economic mismanagement.

This prompted me to check what the score is for the US (for context and my own reference as an American) only to see that Italy has us beat. Not terribly surprising, but still sad to see.

a bit of warning on the data :

it is NOT only about financial knowledge, but also behaviour.

including keeping track of money flows, searching data before spending, etc.

in other words, if you have enough money NOT to have to care on how you make most of your spending, you’ll score poorly.

you’ll also see that the us is suspiciously kept out of the data.

the knowledge is mostly about financial concepts such as inflation (the definition of inflation and the understanding of time value of money), the benefits of long-term saving/investing, interest and risk.

in other words : not as much financial litteracy, than investing litteracy.

and there’s a big lobby at the moment for europeans to invest. so, not exactly a neutral study either.

I guarantee the US is worse

in OECD 38 countries. why only 21 in the graph?

Sparbuch land being first is the funniest thing i read all week

I’m not even going to look at the comments but I’ll bet there’s at least one northern Italian blaming southern Italians for bringing their average down.

If those Italians could read they’d be very upset

https://preview.redd.it/flwklwnp678g1.jpeg?width=1080&format=pjpg&auto=webp&s=0852e2023edcbbd3dd509c67e7de09c50af27fde

Can’t believe Germany is that high up with this amount of pwople voting CxU, FDP and AFD

„Select countries“ – selected by a German maybe?

Even their children’s shows are about winning money, I can imagine them having a weird concept of a healthy economy.

Hungary being above anyone sounds like a joke.

I’ve lived in both Spain (I’m Spanish) and the Netherlands and the difference is absolutely huge , average Dutch person is much much much much more financially educated and responsible than the average spanish

So considering that’s something I know first hand I don’t trust the test that I have no idea

Chile low too, no wonder they both went fascist recently