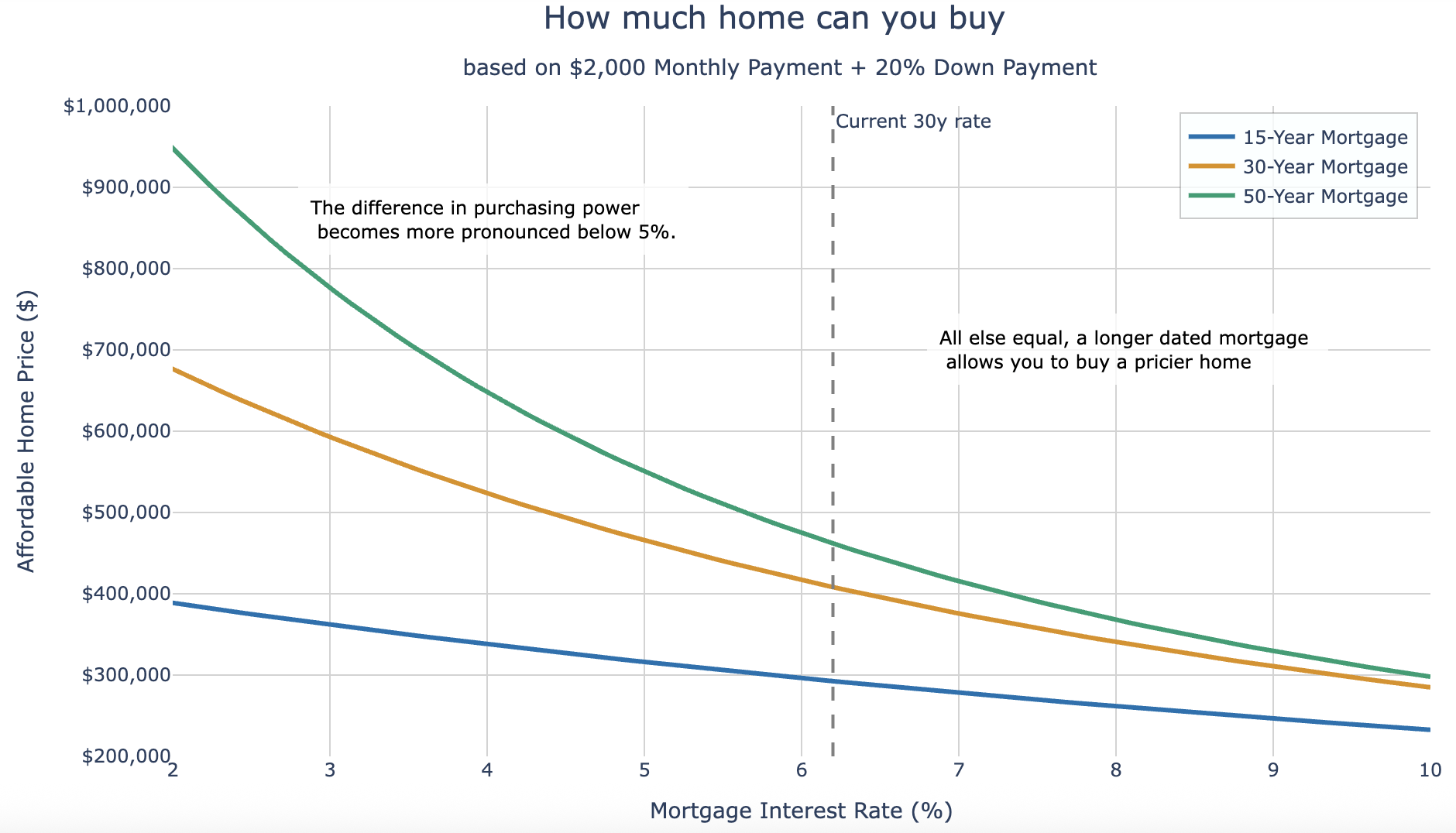

For the same $2,000 monthly payment (plus 20% down), a longer mortgage term lets you afford a higher-priced home because you’re spreading principal repayment over more years.

At a 6.5% rate and a $2,000 monthly payment (with 20% down):

A 15-year loan supports a home around $290k. A 30-year loan raises that to about $400k. A 50-year loan gets you to roughly $450k.

So a 50-year term effectively boosts purchasing power by ~10% relative to a 30-year mortgage at the same interest rate. Of course, the catch is you pay interest for far longer, so total interest costs climb sharply even though the home appears “more affordable” month to month.

True convexity—where each extra year meaningfully boosts buying power—only emerges once mortgage rates drop below roughly 5%.

Edit: Here I was trying to show mortgage math and the hate has been real. I'm glad Redditors don't like debt!

by DataVizHonduran

18 Comments

You’ll never own the home though. You’re basically renting it from the bank. The bank is the only one who wins

Source: OP calc, Tools: Python and Plotly

I wonder about what might happen though if there are more buyers as a result of the change in a market where the number of sellers doesn’t increase.

Would this cause an inflation of price offsetting the increase in buying power.

If you now plot the total interest payments against it, we could nicely how much you would need to prefer the more expensive house now, for the difference lengths to make sense.

As dumb as a 50 year mortgage is, and it is exceedingly dumb, even the payment focused buyers aren’t going to be swayed saving $200 a month I don’t think.

It’s one thing to be exceedingly dumb buying a car for 3-6 years. It’s entirely different with a house for 50 years when they aren’t even that attractive to the buyer to begin with.

I think you mean allows you to live above your means

In tomorrows news: ***water is wet***

If 10% is make it or break it then you can’t afford the home and you have no business buying one.

If you added the down payment, principal payments, and interest payments and made them equal, a 50 year mortgage would dramatically cut your budget.

And you likely die still in debt—don’t forget that part.

Now do a 50-year amortization table, friend

The longer the term, the more you are screwed. Yes, the monthly payment is lower, but the total cost is much higher, and the chances of you paying it off before you die are lower.

This is not a solution to the housing problems in this country. True solutions would include relaxing building codes to allow for smaller home construction, deincentivizing corporations and foreign investors from buying homes en masse, which would reduce demand, and reducing intest rates on small mortgages to incentivize larger down payments and smaller principal amounts.

Ah just what I needed an excuse to spend more money as debt

If a new mortgage product allows you to buy a pricier home, the logical consequence, assuming that demand exceeds supply as it currently does, is that house prices will get more expensive.

+ 20%? So you can literally put down half the money for the 400k home and not sweat your mortgage or you can buy a million dollar home and be paying a mortgage from your retirement earnings.

You are holding the payment fixed but not the down payment. At 650k a 20% down payment is 130k, at $1M you are bringing 200k to the table. You should hold down payment fixed as well. You are also ignoring APR, 15% loans are cheaper because there’s less risk on a short term loan, a 50 year loan would likely carry another 1/2% APR, killing most the extra buying power

Curious to see the relationship between the price of the home you buy and your total payout over 50 years. That’s an additional $2000 per month for 20 years. $480,000.

Using your same numbers (20% down, $2000 monthly payment, 6.5% interest) and with a 100 year mortgage you can buy a $460k house!

100 year mortgage ftw!