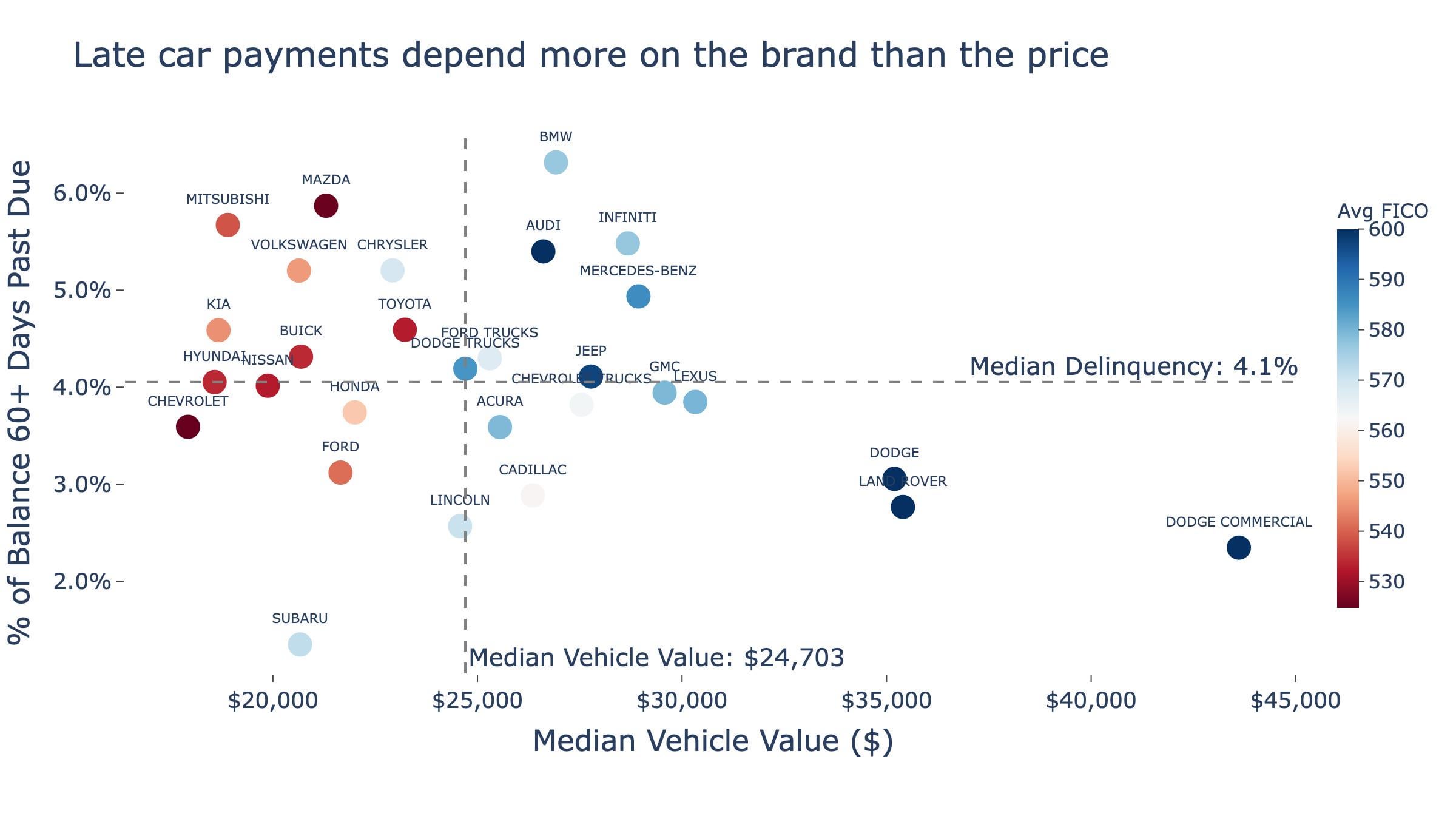

A top comment on my last post wondered if late payments come from pricier cars but maybe it’s more about the brand and the kind of buyer.

The data comes from 35,238 subprime auto loans from Santander Consumer USA (one of the largest subprime lenders in the US). Only manufacturers with at least 50 loans are shown. The dataset covers both new and used cars, which pulls the median value lower.

Each point shows the median vehicle value (x-axis) and share of balance 60+ days past due (y-axis). Color = average FICO score at origination.

by DataVizHonduran