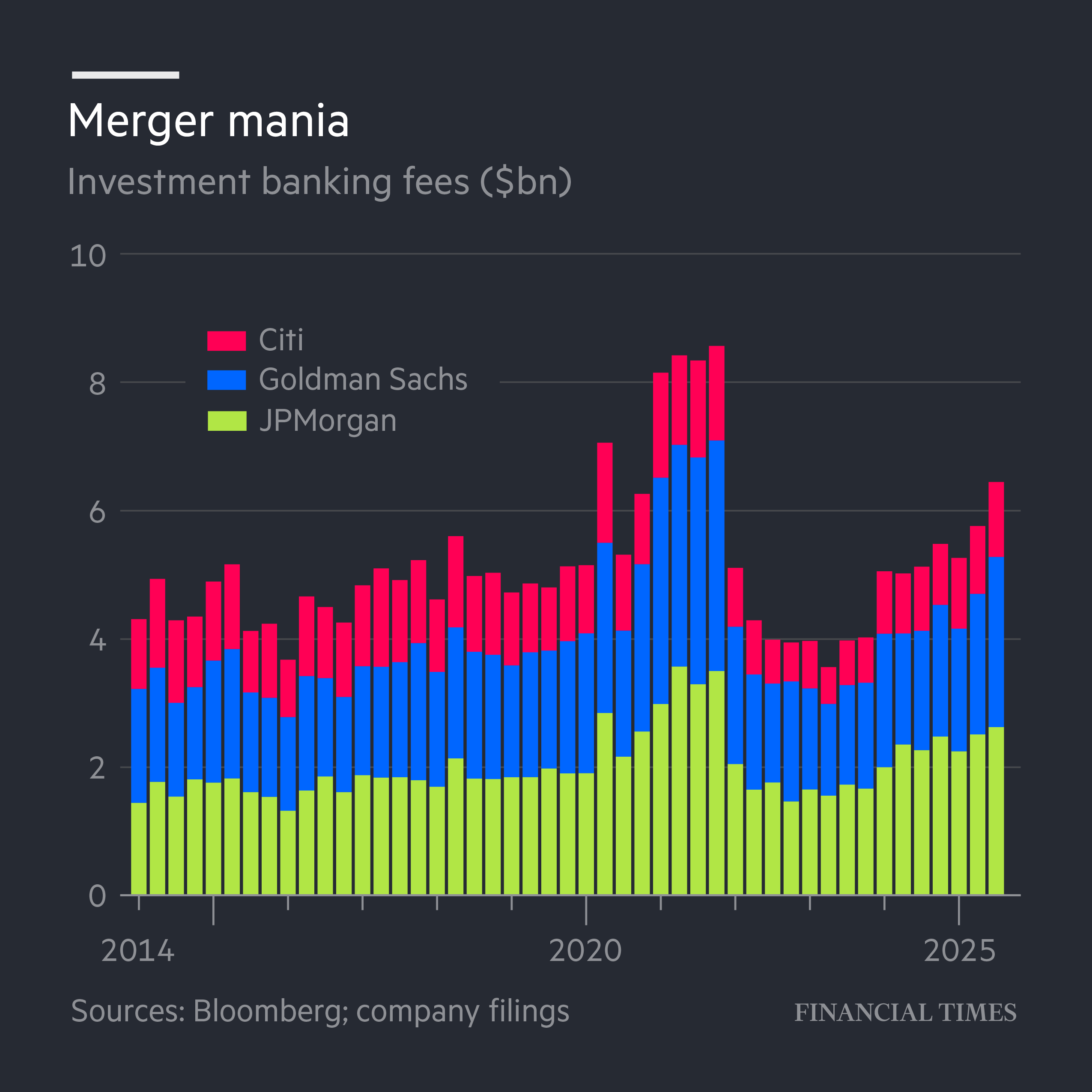

Hi, I'm sharing this story's chart showing how several Wall Street banks pulled in about $6.5bn in advisory work and equity and debt underwriting fees in the third quarter of 2025.

For years, Wall Street’s biggest banks struggled to fire on all cylinders: one division did most of the work. For a while, that was consumer banking. More recently, amid a slowdown in lending and net interest income growth, trading desks picked up the slack. Now, it is dealmakers who are roaring. The difference, however, is that this time other businesses have plenty of momentum of their own.

M&A is booming, with companies globally striking $1tn of deals in the third quarter, one of the busiest in history. As a result, JPMorgan Chase, Citigroup and Goldman Sachs collectively pulled in about $6.5bn in advisory work and equity and debt underwriting fees, 25% more than a year ago.

Looking ahead, there is no immediate reason why the party for Wall Street banks should stop.

Source: Bloomberg; company filings

Victoria – FT social team

by financialtimes

2 Comments

What kind of debt are they underwriting? Seems risky in this economy.

I don’t like stacked charts for non-ordinal data. Maybe try clustered column by bank and a line on the secondary axis for total fees.