Link to interactive version: https://engaging-data.com/tax-brackets/

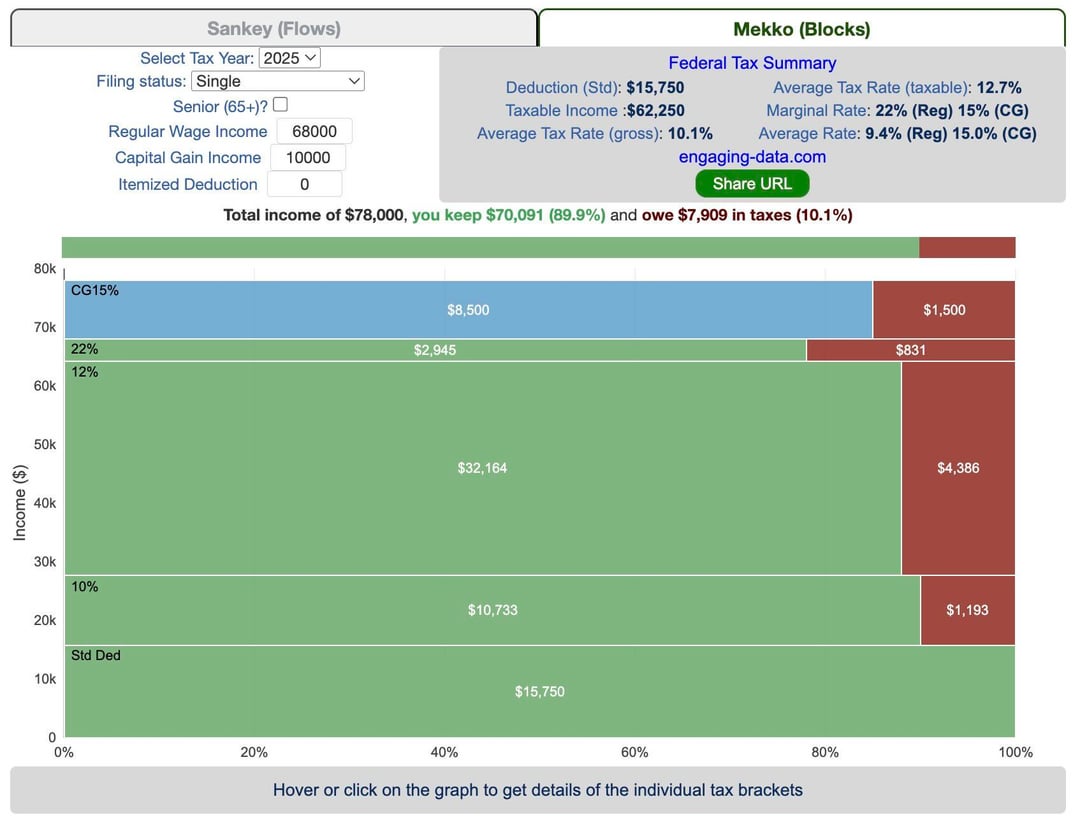

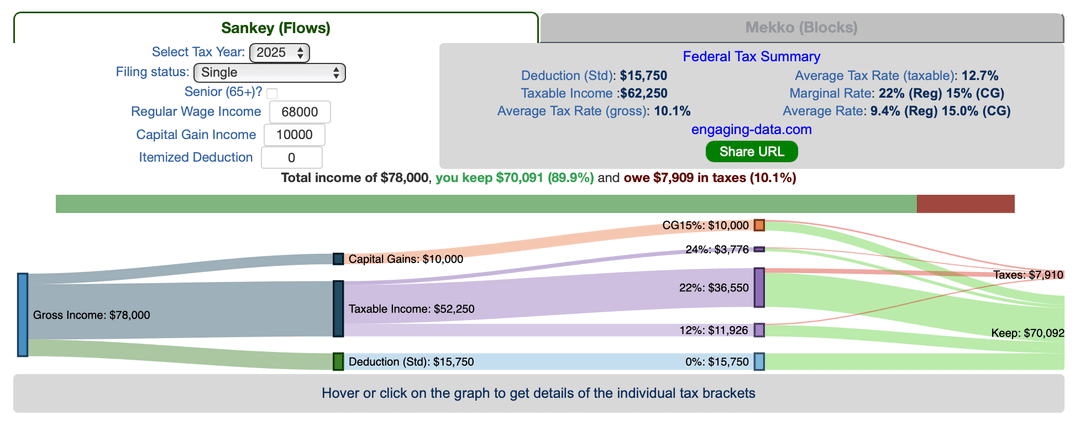

View my tax bracket calculator/visualization. Enter your regular and capital gains income and it calculates your taxes and shows you how the various tax brackets work (how much goes into each bracket and how taxes are applied.

I know many folks have some misunderstandings about how tax brackets work so these graphs can help with showing how the US federal tax brackets work. I added a Mekko graph to the Sankey graph to give a different way to visualize the tax brackets. Also updated the calculations to include the latest tax changes from the 2025 bill, which raises the standard deduction and adds an additional senior deduction.

Data and Tools:

Tax brackets and rates were obtained from the IRS website and calculations were made using javascript, CSS and HTML. The sankey graph was made using code modified from the Sankeymatic plotting website and the mekko graph was made using the Plotly javascript open source library.

by EngagingData

2 Comments

You should include employee contribution via FICA. Your computation is probably (haven’t checked in detail) accurate for income tax exclusively, but it doesn’t represent the standard federal tax burden. If you earn wages you pay FICA in addition to income tax and as your demo graphic points out (by showing how relatively low income tax is), FICA is a huge chunk of most folks’ tax bills.

my comments kinda irrelevant fyi. Cool site. Was looking at the admit rate feature on there and am wondering – is admission contingent on completing a degree in the indicated subject?