Costco does $275 billion in revenue. To put it into context, Microsoft reported $281.7 billion in revenue in 2025. Let that sit for a second.

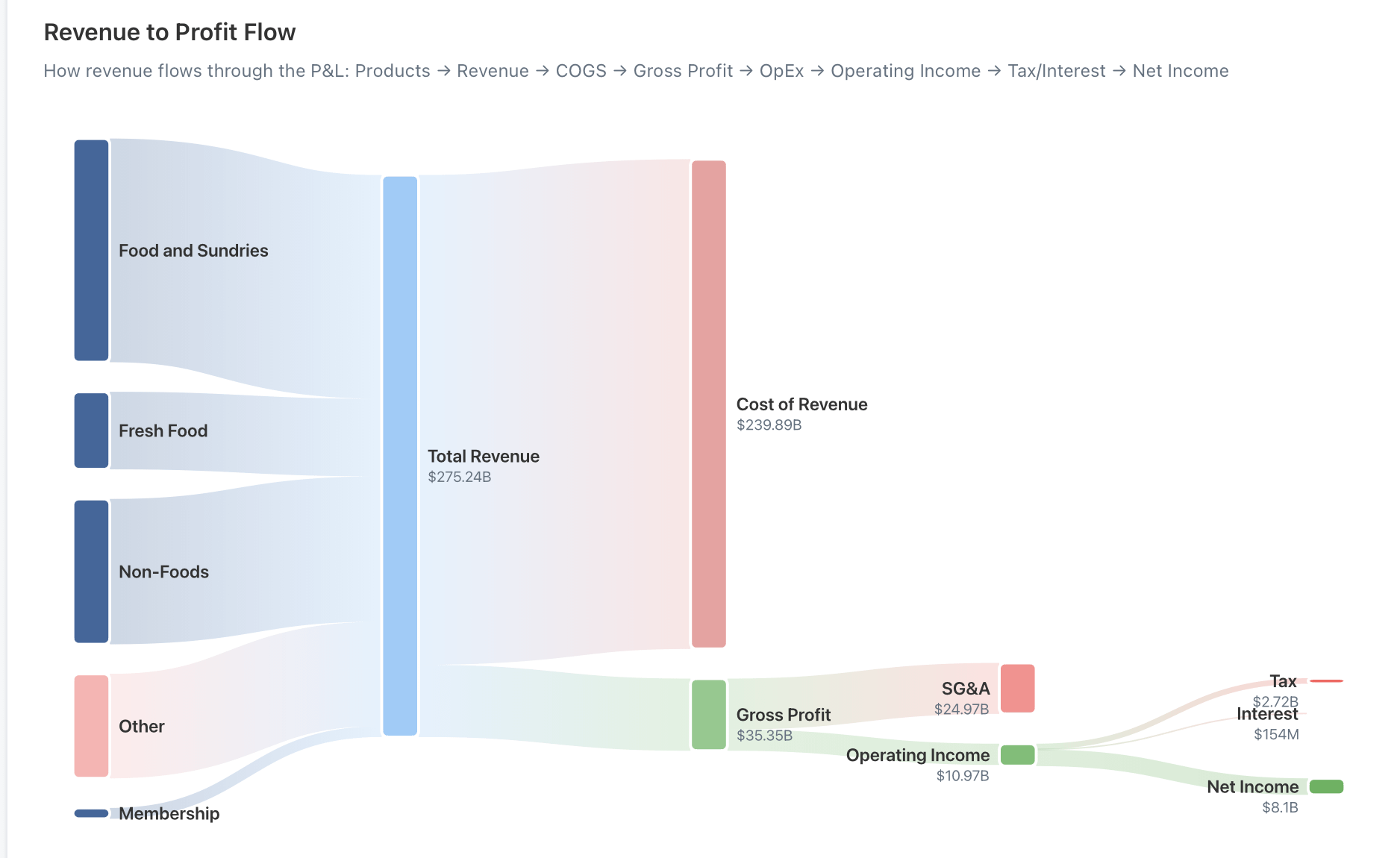

I built a Sankey diagram to trace exactly where that money goes. If you haven't seen one before, each band's width is proportional to its dollar value, and you follow the flows left to right through each stage of the P&L. It's the most honest way I've found to look at a business because you can't skim past an uncomfortable number; you can literally see it drain away. Previously, did Apple's Sankey if you want another example for comparison.

Here's what the diagram shows:

Cost of Revenue swallows $239.89B immediately, 87 cents of every dollar earned. Gross Profit: $35.35B. SG&A takes another $24.97B. After taxes and interest, the final ribbon on the right is Net Income: $8.1B. On $275B of revenue. A 2.9% net margin.

Now look at the tiny band at the bottom left, labelled Membership. Just $5.32B. Less than 2% of revenue.

That band is nearly as wide as the entire net income ribbon.

Membership fees, the annual charge Costco collects just to let you through the door, account for 65.7% of net profit.

It's not just one year fluke. It's been like this for years.

| Year | Net Income | Membership Fees | % of Net Income |

|---|---|---|---|

| 2025 | $8.10B | $5.32B | 65.7% |

| 2024 | $7.37B | $4.83B | 65.5% |

| 2023 | $6.29B | $4.58B | 72.8% |

| 2022 | $5.84B | $4.22B | 72.3% |

| 2021 | $5.01B | $3.88B | 77.4% |

It appears that Costco isn't a retailer that charges membership fees. It's a membership business that runs a warehouse to justify the fee! The $1.50 hotdog and the bargain rotisserie chicken are arguments for renewal, not just products.

What surprised you most?

Data: Costco (COST) FY2021–FY2025 annual filings (sourced from FMP).

Tool: D3.js with d3-sankey layout.

by stockoscope

9 Comments

Source: Costco (COST) FY2021–FY2025 annual filings via Financial Modeling Prep API

Tool: D3.js with d3-sankey layout

Data: Revenue segmentation and income statement data pulled directly from Costco’s SEC filings. Key figures for FY2025: Total Revenue $275.24B, Cost of Revenue $239.89B, Gross Profit $35.35B, SG&A $24.97B, Operating Income $10.97B, Net Income $8.1B, Membership Fees $5.32B.

That “Cost of Revenue” is a whole lotta people’s subsistance strategy. I’d say it looks like a company run for the sake of its employees, as opposed to rent-seeking shareholders.

I like Costco, because that’s the only place where you can get a whole Costco pizza.

It sounds like you think the membership fee is some kind of swindle on the customer?

The membership fee is more than covered by the price savings on the shopping you do there if you go at all regularly. Especially the gas is a killer deal.

What’s cool/crazy is that the membership fee pays for itself. You’re virtually guaranteed to save $65/year on gas alone, on top of Costco already having the lowest prices around.

All the major grocers will, I suspect, end up with a similar margin.

Costco’s bit is that they can magic cheaper prices by charging their margin up front as a membership fee – that’s why their prices can be lower.

It’s a neat use of psychology to differentiate themselves in a tight market – people in general will feel like (and will, in reality, too!) they save more the more they spend there. But the overall average works out about the same as anywhere else.

There’s probably some fancy maths that can be done to work out the break point in weekly grocery spend whereby it’s cheaper to shop elsewhere than Costco, but I can’t be bothered to think about it too hard

I like them even more..

Selling the goods with a very modest profit, membership is the thing, makes it more like the early days of the Co-Op movement in the UK, before the “shareholder is king” arseholes ruined everything there…

As another commenter wrote, a business run for the benefit of the staff and members, not some parasite “investor”.

AND

The top 3 institutional shareholders of Costco:

The Vanguard Group

BlackRock

State Street Corporation

Own enormous amounts of a huge set of companies that Costco contracts out to in order to do the business they do. Haha.

It’s the inception of the business world.

What stands out is how thin the operating margin is relative to total revenue — the membership fees seem to carry a disproportionate share of profitability.