Some notes:

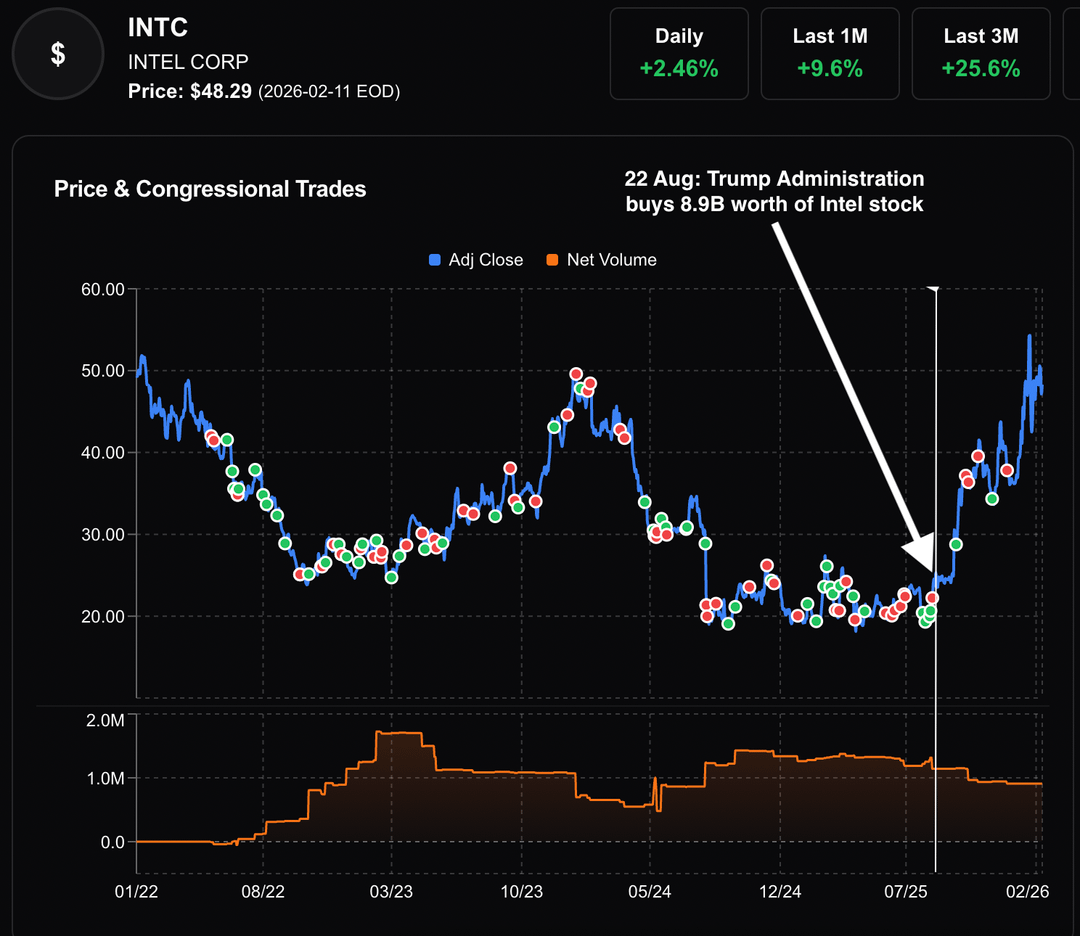

- On 22 Aug, Trump administration made a deal to buy $8.9B of Intel stock at an average price of $20.47 per share.

- Trump Admin is now up +136% from that trade.

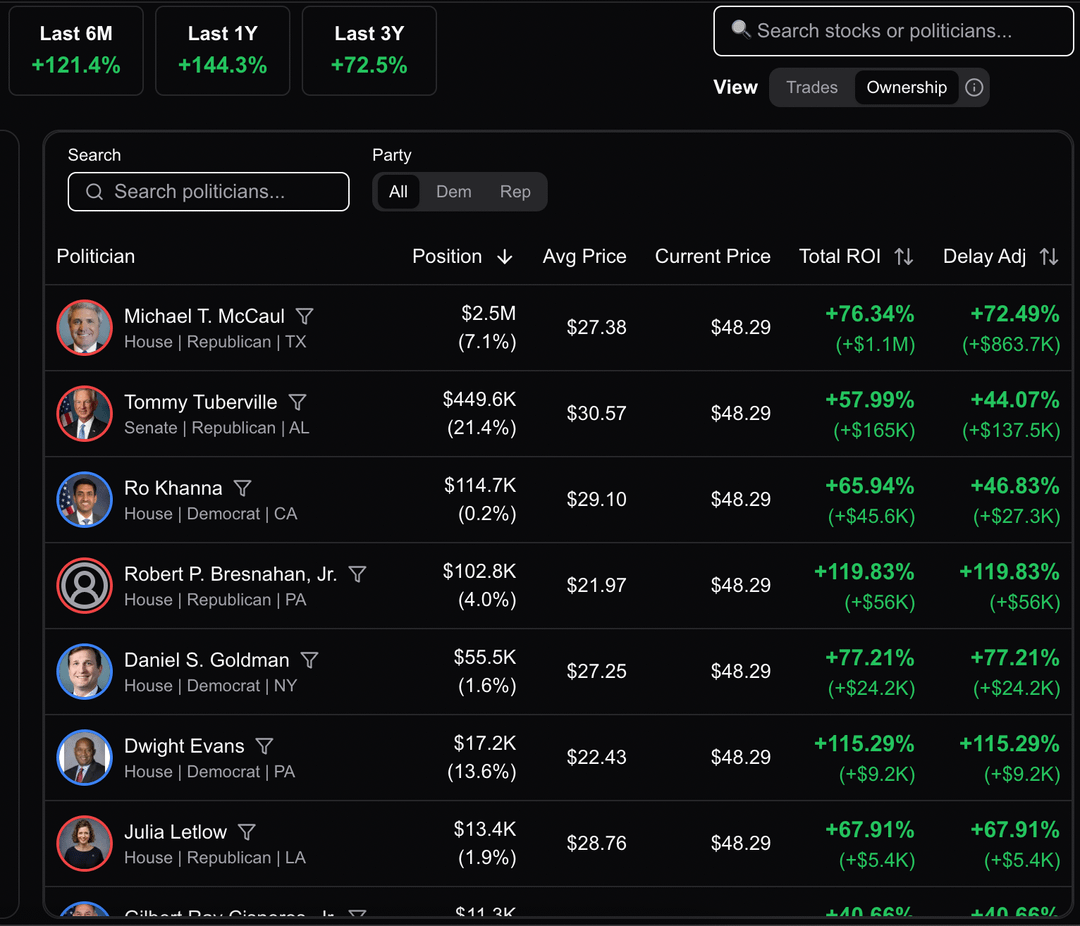

- Michael McCaul (R-TX) is the biggest holder with $2.5M, he is up +76.3%. From the Dems, the biggest holder is Ro Khanna with $115K, who is up +46.8%

- The chart shows Congressional trades on Intel stock: each green dot is a buy, each red dot is a sell.

Source: insidercat.com based on House/Senate financial disclosures

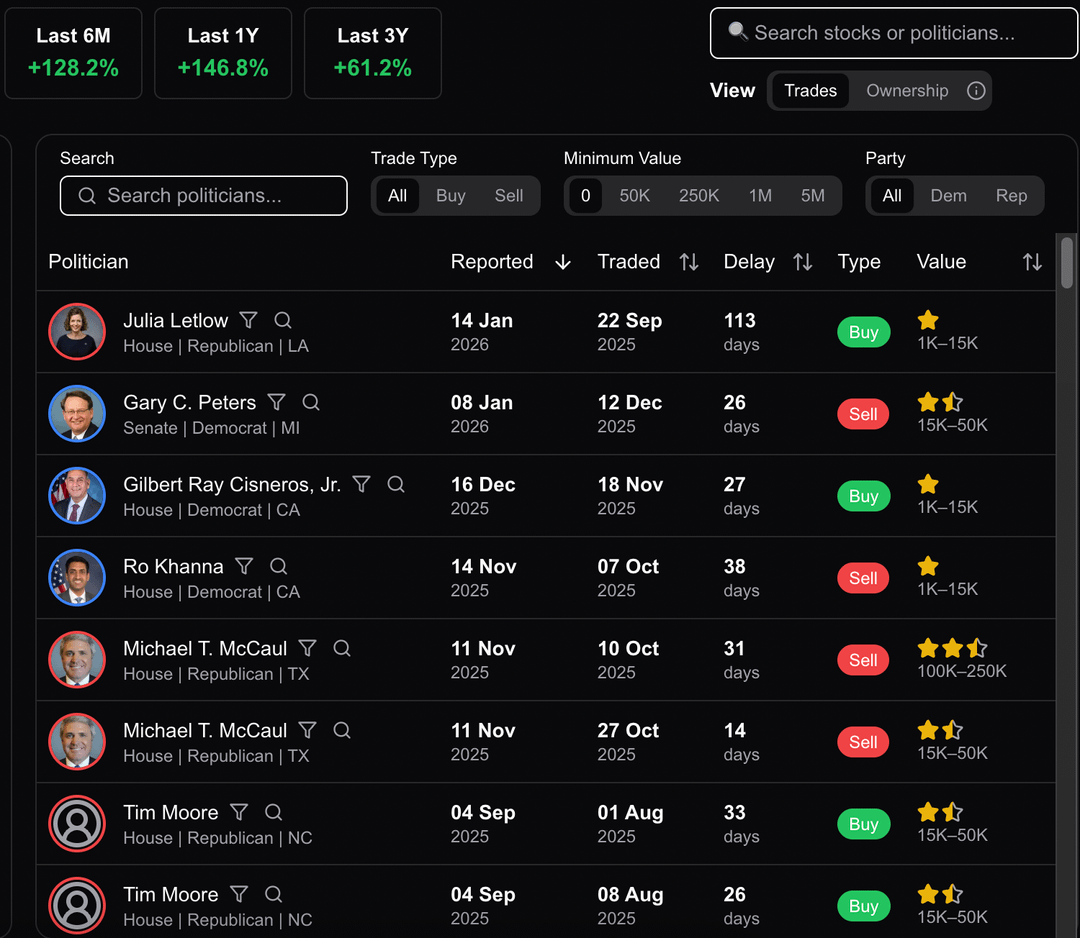

See 2nd pic for Congressional ownership, 3rd pic for recent trades by members of Congress.

by Due_Patient_2650

5 Comments

We pulled House/Senate financial disclosures since 2022-May for INTC. For dollar values, we took the midpoint of the value ranges in the disclosures.

There might be errors in the data as some of the disclosure documents are literally filed by hand. Congress members have to declare their stock transactions in 45 days per STOCK act, though most disclose within 2 weeks.

Data source: House/Senate financial disclosures (all are in public domain).

To learn more on Trump admin & Intel deal: [https://www.intc.com/news-events/press-releases/detail/1748/intel-and-trump-administration-reach-historic-agreement-to](https://www.intc.com/news-events/press-releases/detail/1748/intel-and-trump-administration-reach-historic-agreement-to)

Tools: Python for data pipelines, Next.js for visualization and display

The amount of corruption in this administration is unprecedented.

They should just rename Congress as The Inside Trader’s Club

As someone who is colorblind, red and green dots do this viz a disservice. If you’re committed to the color scheme, maybe use different symbols for buy/sell in addition to color?

Am I missing something here, or does it look like Intel stock buys were happening quite frequently *whenever* the price went low for the last four years, then got even more frequent when it went *really* low? I bought quite a tranche of it last year at that really low point, as people were talking about the likelihood of Intel “failing”. I quickly realized that was an enormous opportunity, as the idea of a US-based semiconductor giant being allowed to die, or being sold to foreign interests, was strategically ridiculous. I didn’t anticipate government investment, but it hardly mattered. Jensen Huang could’ve rolled his spare change and bought it – and would have.

My point being – I ain’t that bright, yet I caught on and had the money to buy. Is it ridiculous that some congressmen with decent financial advisors would do the same? I think not.

I’m pretty savagely anti-politician, but this case looks weak to me.