Link: https://caniretirethere.com

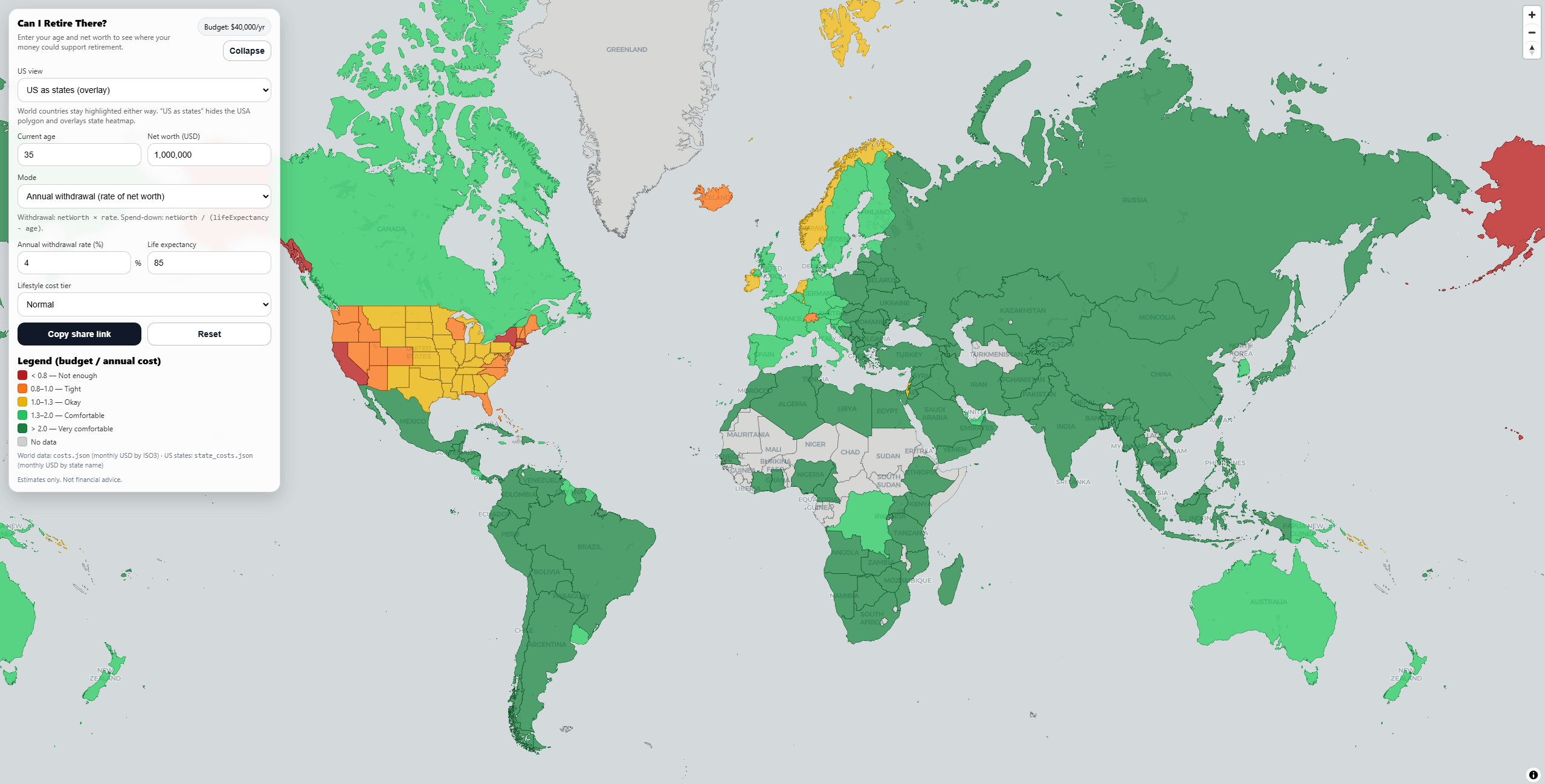

I made a simple interactive map that estimates where you could afford to retire based on your age + net worth.

It supports two modes:

- Withdrawal rate (default 4%, adjustable)

- Spend-down (net worth divided across remaining years using life expectancy)

You can also toggle US as a country vs US states and choose a lifestyle tier (frugal/normal/comfy).

Assumptions/limits: it’s a rough MVP (cost data is estimated, not financial advice, doesn’t include taxes/healthcare/visa/returns).

I’d love feedback on one thing: what single feature would make this actually useful for you? (e.g., taxes, healthcare, rent vs non-rent, inflation, etc.)

by NoRoad6979

14 Comments

Why is Alaska red?

Don’t you get 1,000 USD simply by living there?

kinda lame you cant set your own ‘per year needs’. The numbers are very low and i think just assume single life in the lowest COL area in the state. ‘comfy’ (highest tier) in cali at 78k/yr seems wildly low, at least with a spouse.

and I’d say the majority of cali, 78k/yr is not ‘comfy life’, as 2 steps above ‘frugal’.

also, does this just entirely ignore taxes? and healthcare… and well reality?

Arizona would be “tight”? No way man, there are plenty of shit hole neighborhoods in Tucson where you could do just fine for 30 or 40 years on 1 million

What’s the assumption on retirement age? Or is this “if I retire today at current net worth?”

I would also incorporate the inclusion of Social Security.

Aldo, a lot of those European countries… If you’re an American, they require a certain amount, like $30,000 a year, of passive income in order to retire there. That’s also a cost.

Edit: this is kind of a cool project though. I think you’re onto something, it just needs more fine grain grained detail, some of which you mentioned in your post.

Some situations here that could be variables and make a huge difference. For example –

Own house outright Y/N

Healthcare – National vs ACA subsidies vs Out of Pocket

Percent of withdrawals that are taxable

Etc

my no1 feature to add – it would be great if you could add ‘investment return rate’ as a variable. it’s highly unlikely anyone would keep their retirement as cash, so being able to model the impact of different rates of return on how long your money would last.

if I had a second, it would be an option to add your likely SS income based on your retirement age. that will also have a significant impact on how long your own money will last.

thx 🙏

I don’t know where you got this data from but Australia would not be green. You would barely be able to afford a house and wouldn’t have much left over. And even if you rented you need to be dead by 60 at the latest

Obviously Canadian provinces, since being able to afford Saskatchewan is very different from Vancouver.

You should add a feature that allows you to “invest” the money with a selectable return rate, and also simulate inflation rate per year. Both of those will factor in a lot.

Also if you can set your budget per month or per year and show the amount of money you would need, kind of going backwards from how you have it now would be a good option.

Good work so far!

I don’t want to do a huge derail but this issue of annual income goes pretty deep. Mike Green wrote a now widely discussed [article](https://www.yesigiveafig.com/p/part-1-my-life-is-a-lie) in which he claimed that a reasonable income for a family of four would be about 140000/year in the US. He gets some push-back but I think directionality he is correct. The cost of child care in particular is not being factored in. Maybe you could make a similar chart for young working age people wishing to relocate. In the expat sub I sometimes see nurses from New Zealand trying to decided between Australia and the US. For me it is a slam dunk that Aus is better but the map would help a bit.

Nice idea but unrealistic numbers, at least for Europe. 1 mil net worth gets you a payed off house and about 400 or less left in cash i would say, which is far from enough to retire. Would try to separate living space (based on m2 as those prices you can easily find for most countries / major cities) and savings / investments. + adding passive income as this is not directly translated into net worth (in Belgium for instance lots of people invest in real estate for their passive income)

Don’t let the haters get to you, I think this is a cool project.

Some suggestions: I’m not sure that it should default to withdrawal rate. It’s not how most people retire, and it led me to several minutes of confusion on why the age and life expectancy fields didn’t seem to change the map at all, because I assumed it was spend down. Honestly, it would be good to just remove the age/life expectancy buttons when on withdrawal rate mode to avoid confusion. Also, I’d rename “current age” to something like “planned retirement age” to make it clear it can be used as a more broad retirement calculator, not just only for where you can retire right now, since most people aren’t going to actually retire right now.

Defaulting US life expectancy to 85! 🤣