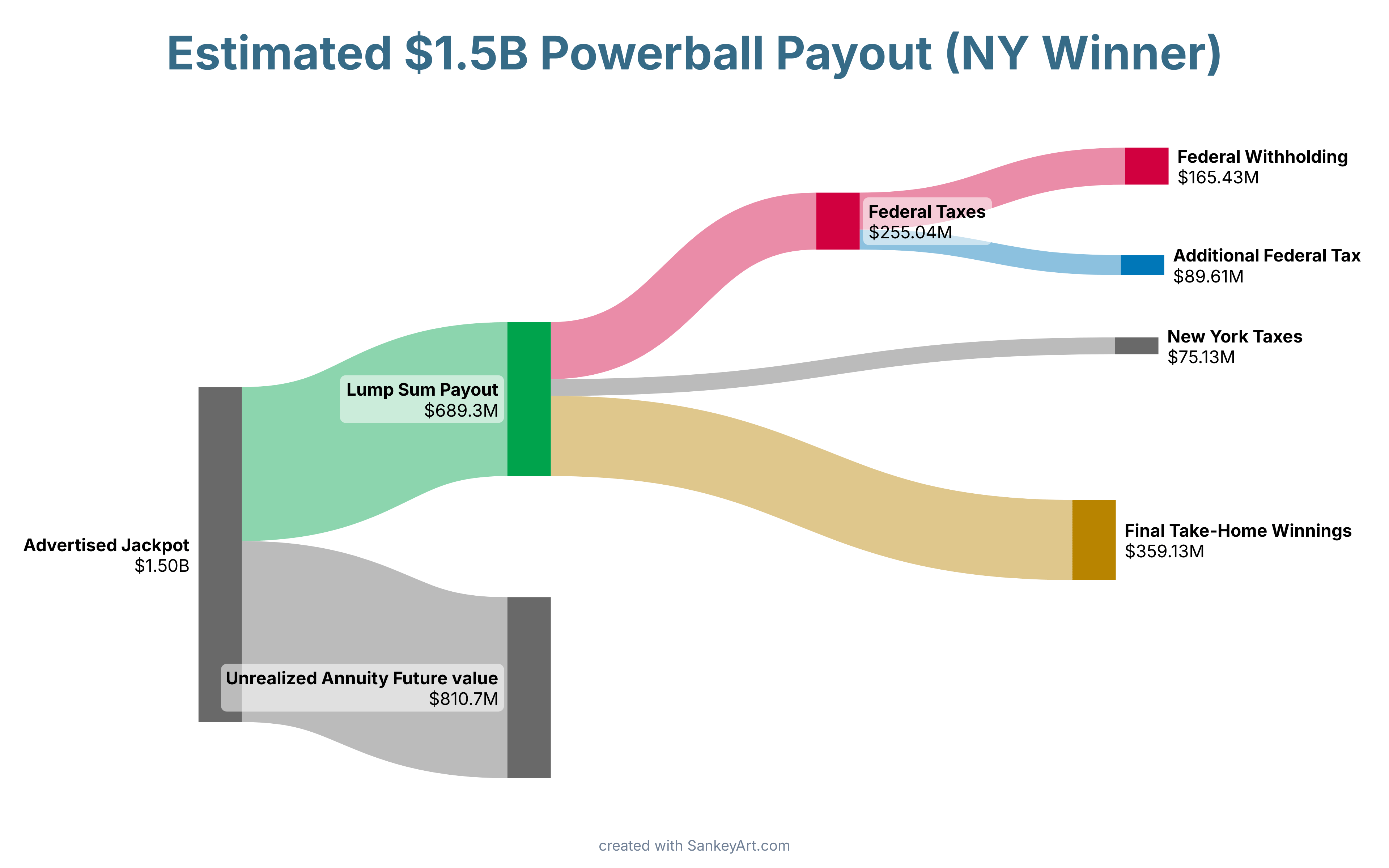

Based on the figures from this Forbes article, adjusted to the $1.5B jackpot for Saturday.

I chose New York state since NY has the highest lottery state tax at 10.9%, some states like California and Florida do not tax lottery winnings at all.

The 10.9% is only if the winner is from Upstate NY:

- If in NYC, you'd pay an additional $26.71 million in local taxes

- If in Yonkers, you'd pay an additional $10.18 million in local taxes

Assumed the highest marginal tax rate of 37%

Visualization tool: sankeyart.com

by GoForthandProsper1

8 Comments

What the hell am I supposed to do with a measly $359M??

Interesting. I had no idea that the jackpot value included unrealized gains. Makes since why the total payout is much lower.

What’s unrealized annuity future value?

So? Its a little over half of the lump sum. What were you expecting?

Maybe I’m dumb but am I the only who never realized the lottery payout is just a combination of the annuity + the lump sum and you can only pick one?

wtf??

That won’t even pay for a Ballroom!

If you invest 300m at 5.5% you would get about 5x after 30 years, so 1.5B while still having 59.13 million to live of.

Do you really mean future value of the annuity, or PDV?

Seem strange to have the lump sum be real, today dollars but the annuity be some ‘future’ value.