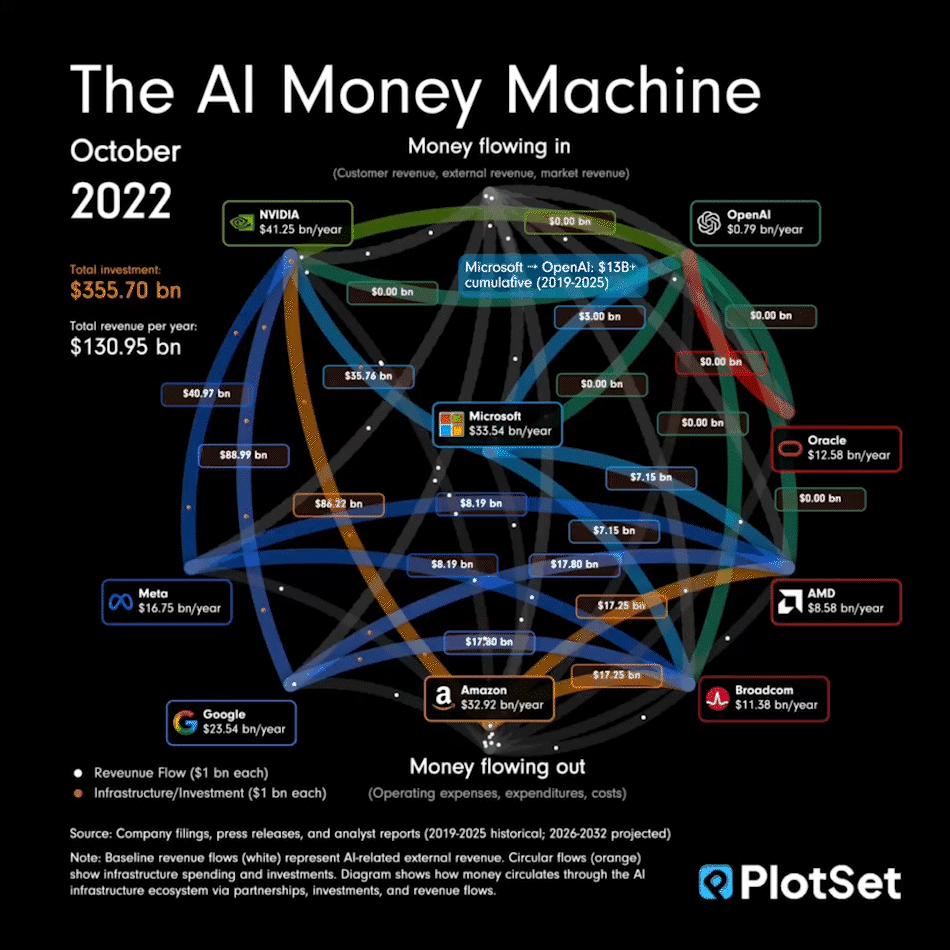

This was difficult to map. It is the circular flow of capital through the AI infrastructure

economy. I'm one of the co-founders of PlotSet and I created this.

Data Sources:

All data collected from SEC filings, official company press releases, and verified financial news reports (Bloomberg, WSJ, TechCrunch). Where AI-specific revenue wasn't disclosed, I used reported segment data (e.g., NVIDIA's Datacenter segment, Microsoft's Intelligent Cloud). Deal amounts come from official announcements: Microsoft's $13B investment in OpenAI, Oracle's $300B five-year contract, NVIDIA's $100B partnership (letter of intent). Each flow is marked as either Verified (67%), Estimated (23%), or Projected (10%).

Technical Implementation:

Built with D3.js. Companies are nodes, money flows are animated particles moving between them. The simulation has revenue figures interpolated monthly between annual data points. Video captured using Puppeteer headless browser.

Key Finding:

By 2027, OpenAI's projected annual infrastructure commitments ($103B to Oracle, NVIDIA, AMD, Broadcom) will exceed its projected revenue ($29B) by 3.5x, requiring continuous external capital injection. This shows how the ecosystem creates circular revenue flows that may mask fundamental sustainability issues.

Limitations:

OpenAI is private (relying on leaked docs reported by TechCrunch), most companies don't separately report AI revenue (requiring estimates), and by Q3 2025 data assumes announced deals execute as planned.

by jcceagle

3 Comments

This was difficult to map. It is the circular flow of capital through the AI infrastructure

economy. I’m one of the co-founders of PlotSet and I created this.

**Data Sources:**

All data collected from SEC filings, official company press releases, and verified financial news reports (Bloomberg, WSJ, TechCrunch). Where AI-specific revenue wasn’t disclosed, I used reported segment data (e.g., NVIDIA’s Datacenter segment, Microsoft’s Intelligent Cloud). Deal amounts come from official announcements: Microsoft’s $13B investment in OpenAI, Oracle’s $300B five-year contract, NVIDIA’s $100B partnership (letter of intent). Each flow is marked as either Verified (67%), Estimated (23%), or Projected (10%).

**Technical Implementation:**

Built with D3.js. Companies are nodes, money flows are animated particles moving between them. The simulation has revenue figures interpolated monthly between annual data points. Video captured using Puppeteer headless browser.

**Key Finding:**

By 2027, OpenAI’s projected annual infrastructure commitments ($103B to Oracle, NVIDIA, AMD, Broadcom) will exceed its projected revenue ($29B) by 3.5x, requiring continuous external capital injection. This shows how the ecosystem creates circular revenue flows that may mask fundamental sustainability issues.

**Limitations:**

OpenAI is private (relying on leaked docs reported by TechCrunch), most companies don’t separately report AI revenue (requiring estimates), and by Q3 2025 data assumes announced deals execute as planned.

Congratulation.

You animate a patchinko machin

AI data centers are killing people.

https://www.tiktok.com/t/ZTrsmVoRA/