Most private equity investors negotiate standard protections when investing in companies. Board seats, veto rights, exit mechanisms, liquidation preferences. These provisions get copied from deal to deal because they're industry standard.

I analyzed data from an academic study that examined 158 PE investments in Indian private companies. The researchers compared what investors typically negotiate for against what's actually enforceable under Indian corporate law based on statutory provisions and court precedent.

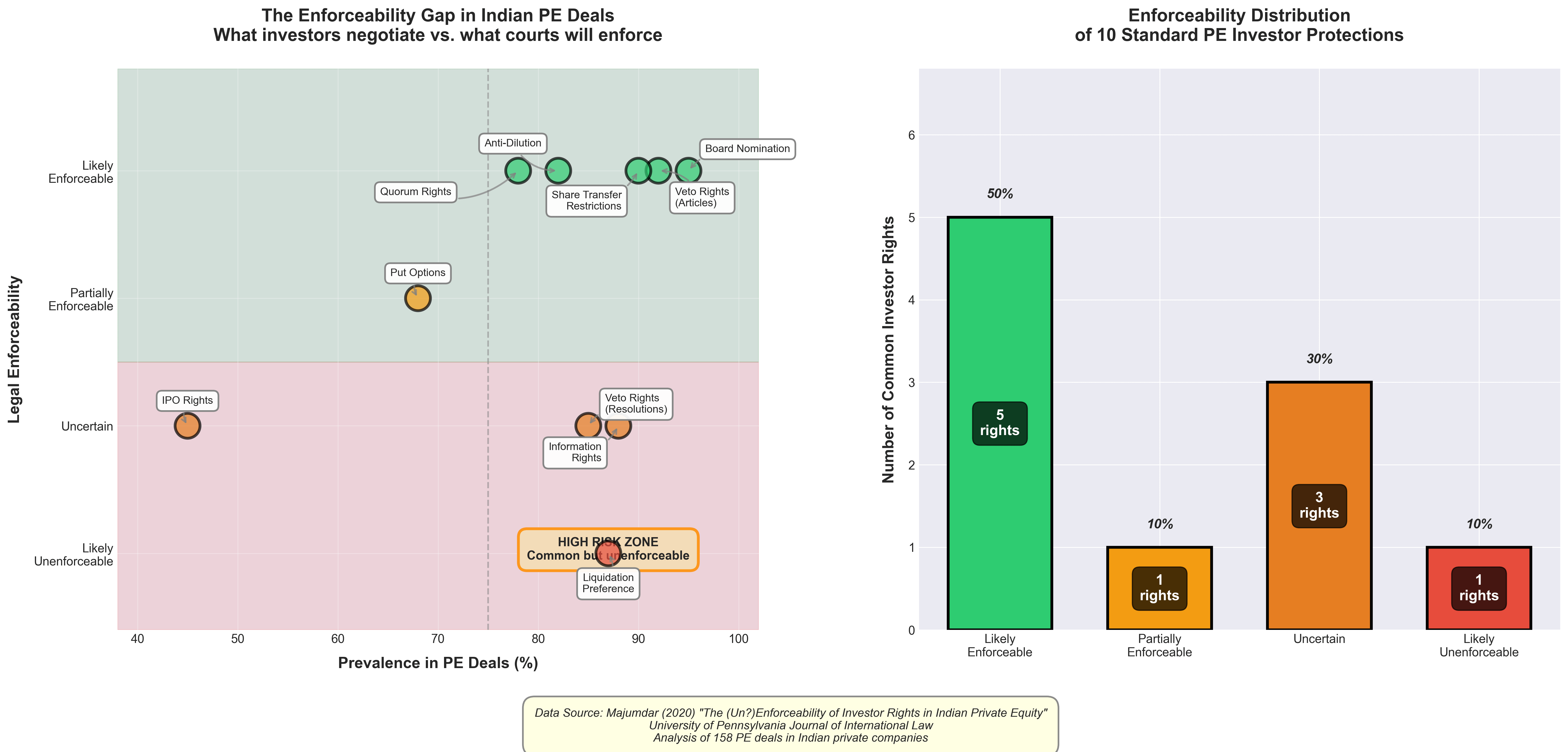

The visualization shows the relationship between how common each provision is (horizontal axis) and how likely it is to be enforceable (vertical axis). The top right quadrant is where you want to be. Common provisions that courts will uphold and the bottom right is the danger zone. Provisions that appear in most deals but may not survive legal challenge.

The striking finding is that liquidation preferences, which appear in 87% of deals and are considered fundamental to PE investing globally, are likely unenforceable under India's bankruptcy code. The code requires equal treatment of shareholders within the same class. There's no provision allowing private ordering of priority among equity holders.

Similarly uncertain are provisions around IPO control and veto rights on certain shareholder decisions. These exist in a legal gray area that's never been tested in court because PE disputes typically settle rather than litigate.

The right panel shows that only 30% of these common investor protections are clearly enforceable and another 40% exist in legal uncertainty or are only partially enforceable.

The interesting systemic point is that because PE disputes rarely go to trial, nobody knows which provisions would actually hold up in court. The market operates on what the study calls an "enforcement fiction" where everyone uses the same clauses because that's standard practice, without knowing if they work under local law.

The data also showed that 64% of these deals involved investors taking 25% or less equity stake. These investors can't independently block major corporate actions and are entirely dependent on their negotiated special rights for protection. If those rights turn out to be unenforceable, their downside protection is much weaker than they think.

Tools – Python (matplotlib, seaborn, pandas)

Data source: Majumdar (2020) "The (Un?)Enforceability of Investor Rights in Indian Private Equity" University of Pennsylvania Journal of International Law, analysis of 158 PE transactions https://scholarship.law.upenn.edu/cgi/viewcontent.cgi?article=2011&context=jil

by Super_Presentation14