🇺🇸 🤝 🇨🇦 🇲🇽 The US needs Canada and Mexico to stay competitive, but next year's USMCA renegotiation could change everything… read on ↓

Last month, Latinometrics was in Mexico City for the North Capital Forum, which brought together business leaders, diplomats, policymakers, analysts and much more to discuss the future of North American integration.

Our Chief Editor even moderated a panel entitled Data for Decision-Making which featured a round-table discussion with business leaders from AT&T, GBM, ANPACT, Tule Capital, and Cabrera Capital Markets.

As part of this panel, we prepared a number of charts to drive discussion. You can find them all here, along with some key insights from the panel.

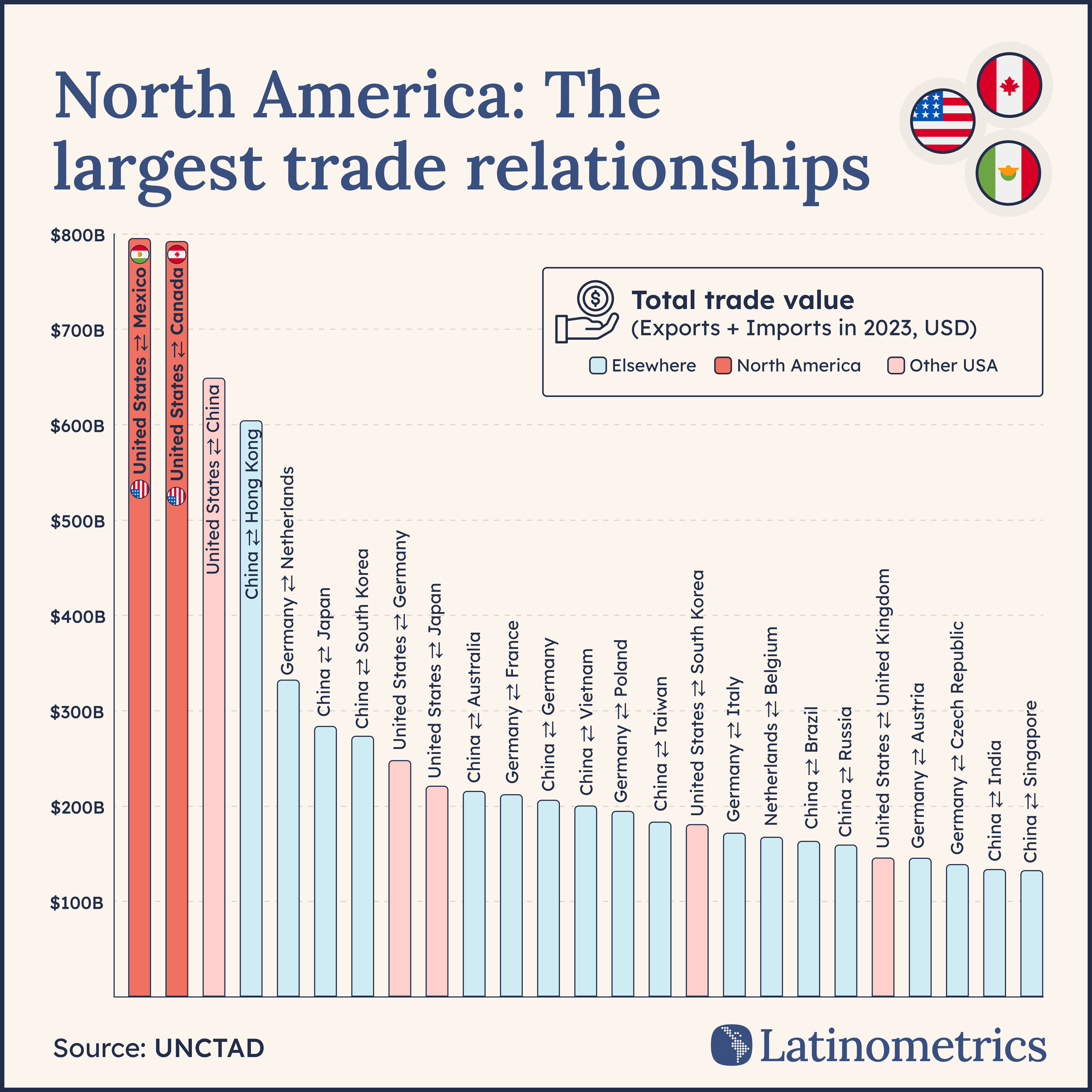

North America is home to the two largest trade relationships worldwide, led by the $800B US-Mexican commercial relationship. And perhaps no sector better encapsulates this relationship than the automotive industry, which has become a symbol of sorts for North American integration.

To Rogelio Arzate, executive president of Mexican heavy-vehicle association Asociación Nacional de Productores de Autobuses, Camiones y Tractocamiones, A.C. (ANPACT), this industry is facing two main red flags:

A lack of supply chain synchronization across borders, and low credit access to other technologies. Yet, as Arzate highlights, the sharing of data and growing local content supplies (over Asian imports) offers huge potential for strengthening auto growth.

The latter of these two points, on local content requirements, is how the car industry and others hope to avoid soaring US tariffs. By ensuring compliance with the United States-Mexico-Canada Agreement, which is due for renegotiation next year, businesses can steer clear of painful trade barriers. The important thing is getting all sides to recognize the importance.

The USMCA is critical even when domestic politics pretend otherwise, as highlighted by CCM founder and CEO Martin Cabrera:

"The US needs Canada and it needs Mexico to be competitive. [Next year’s renegotiation] is about really going in there, getting it done quickly, so we can move forward and continue the growth in all three countries."

Of course, not all countries have equal leverage. Mexico is no doubt the country most exposed to the US worldwide, given 80% of its exports head north each year, so tariffs are almost uniquely dangerous. Given this, we asked Miriam Acuña, chief economist at GBM, how markets had evaluated Mexico’s performance vis-à-vis trade tensions.

Acuña noted that investors have tended to reward Mexico’s government for its smooth handling of both domestic and foreign economic matters, as evidenced by the peso’s 10% appreciation this year. Per her, the current Sheinbaum administration’s smooth relations with the US government despite tariff impositions, as well as policy certainty, fiscal consolidation, and export diversification have all helped calm international markets in turbulent times.

story continues… 💌

Source: UNCTAD

Tools: Figma

by latinometrics