💳 🇲🇽 Why do most Mexican credit cards have limits below $1,600 USD? the answer reveals everything… let's explore ↓

In 2018, there were 7.7B credit cards in the world, meaning slightly more cards than human beings on Earth.

Partly this makes sense, especially when you consider that one friend you have who’s overly into finance and who tries to maximize points through nineteen different credit cards.

Yet across much of Latin America, millions of people actually live without the plastic. As of 2023, a whopping 42% of Latin Americans didn’t have a credit card—which isn’t to say this isn’t slowly changing in countries like Mexico.

In Latin America’s northern giant, the credit card market is booming, and formal banking is on the rise. BBVA and Tarjetas Banamex are leading the charge in the growing financial inclusion of everyday Mexicans.

But who are these cards really built for and how much can they spend?

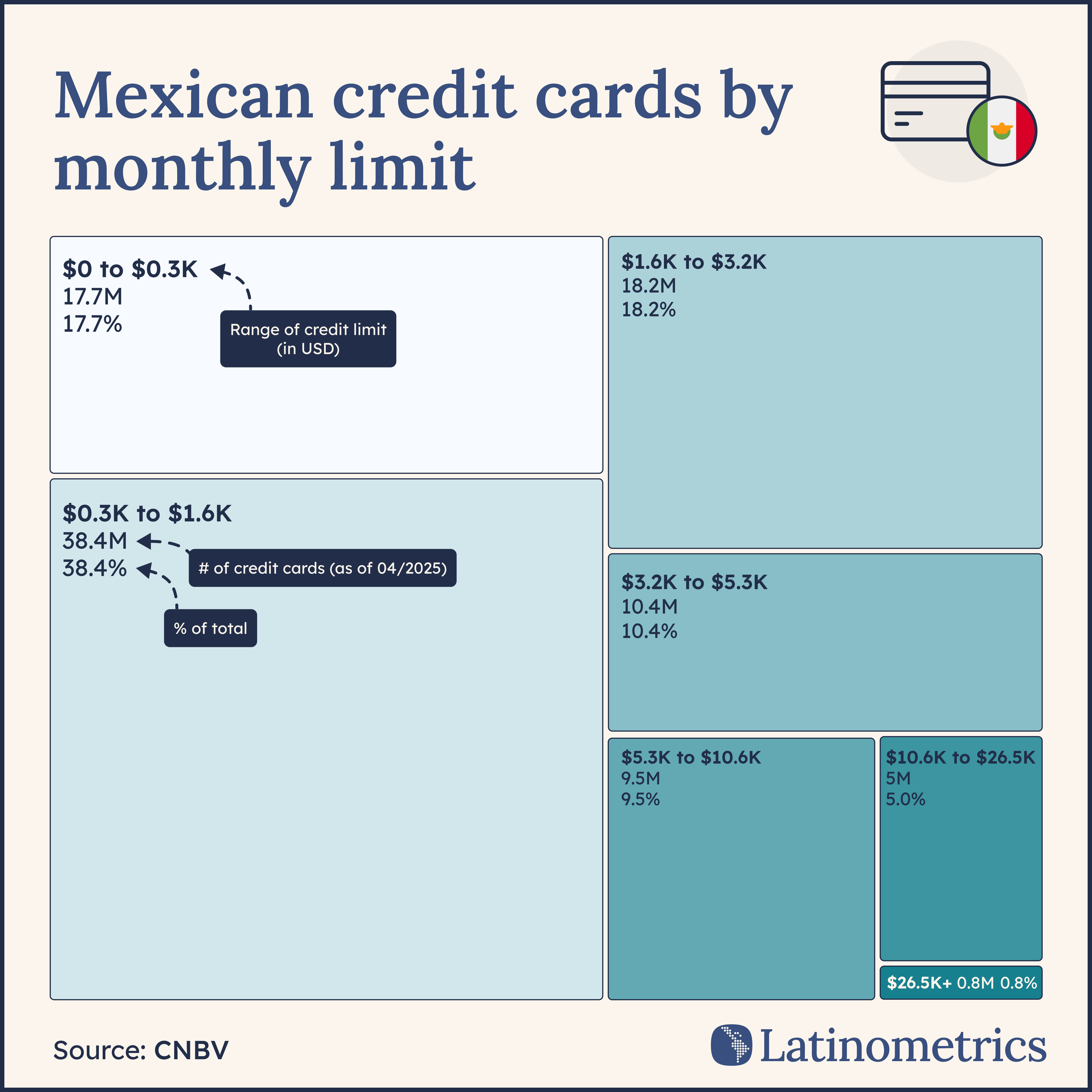

Most local credit cards are clearly built for everyday purchases rather than big splurges, given that over half have a monthly limit below $1600. This indicates a market heavily weighted towards the large Mexican middle- and working-class population.

[story continues… 💌]

Source: Portafolio de Información

Tools: Figma, Rawgraphs

by latinometrics