Data Source:

– U.S. Exports of Goods & Services from FRED / ALFRED (U.S. Census Bureau)

– EUR/USD intraday FX quotes from Capital On market data feed

Tools Used:

– Python (pandas, numpy, matplotlib)

Methodology:

-

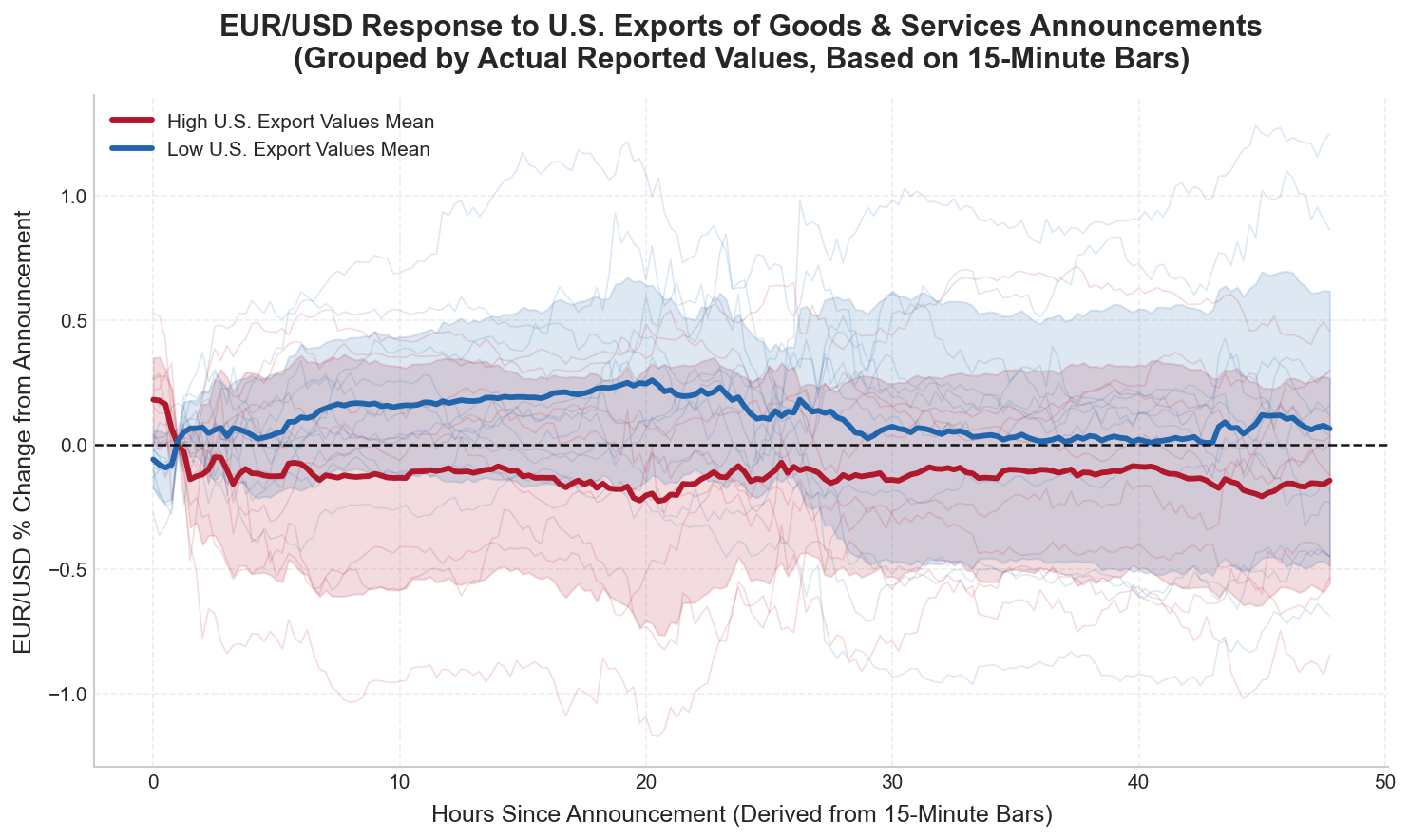

Each U.S. Exports of Goods & Services announcement was aligned with the nearest EUR/USD 15-minute bar.

-

Price windows of 48 hours (192 bars) following each announcement were analyzed.

-

Announcements were grouped into “High” vs. “Low” actual export values (split by median).

-

The chart shows the mean % change in EUR/USD after each release, with ±1 standard deviation bands.

-

The dashed line at 0% marks no change relative to the announcement.

Context:

This chart comes from a broader study of **32 major U.S. macroeconomic releases**, examining how each event’s actual value and surprise component relate to short-term EUR/USD structure.

Among all events, **U.S. Exports of Goods & Services** produced the **lowest Variation of Information (VI = 0.795)** — meaning it was the **most predictive** of short-term EUR/USD trend direction immediately after announcements.

Trade and GDP indicators consistently showed stronger informational linkage than inflation or sentiment data.

Full analysis and article:

🔗 https://yellowplannet.com/decoding-eur-usd-the-u-s-economic-events-that-matter-most/

by SilentAnimator2752

1 Comment

Data Source:

– U.S. Exports of Goods & Services from FRED / ALFRED (U.S. Census Bureau)

– EUR/USD intraday FX quotes from Capital On market data feed

Tools Used:

– Python (pandas, numpy, matplotlib)

Methodology:

1. Each U.S. Exports of Goods & Services announcement was aligned with the nearest EUR/USD 15-minute bar.

2. Price windows of 48 hours (192 bars) following each announcement were analyzed.

3. Announcements were grouped into “High” vs. “Low” actual export values (split by median).

4. The chart shows the mean % change in EUR/USD after each release, with ±1 standard deviation bands.

5. The dashed line at 0% marks no change relative to the announcement.

Context:

This chart comes from a broader study of 32 major U.S. macroeconomic releases, examining how each event’s actual value and surprise component relate to short-term EUR/USD structure.

Among all events, U.S. Exports of Goods & Services produced the lowest Variation of Information (VI = 0.795) — meaning it was the **most predictive** of short-term EUR/USD trend direction immediately after announcements.

Trade and GDP indicators consistently showed stronger informational linkage than inflation or sentiment data.

Full analysis and article:

🔗 [https://yellowplannet.com/decoding-eur-usd-the-u-s-economic-events-that-matter-most/](https://yellowplannet.com/decoding-eur-usd-the-u-s-economic-events-that-matter-most/)