Data: FRED / ICE BofA

Analysis & Visualization Packages in R: fredr, tidyverse, lubridate, scales, showtext, patchwork

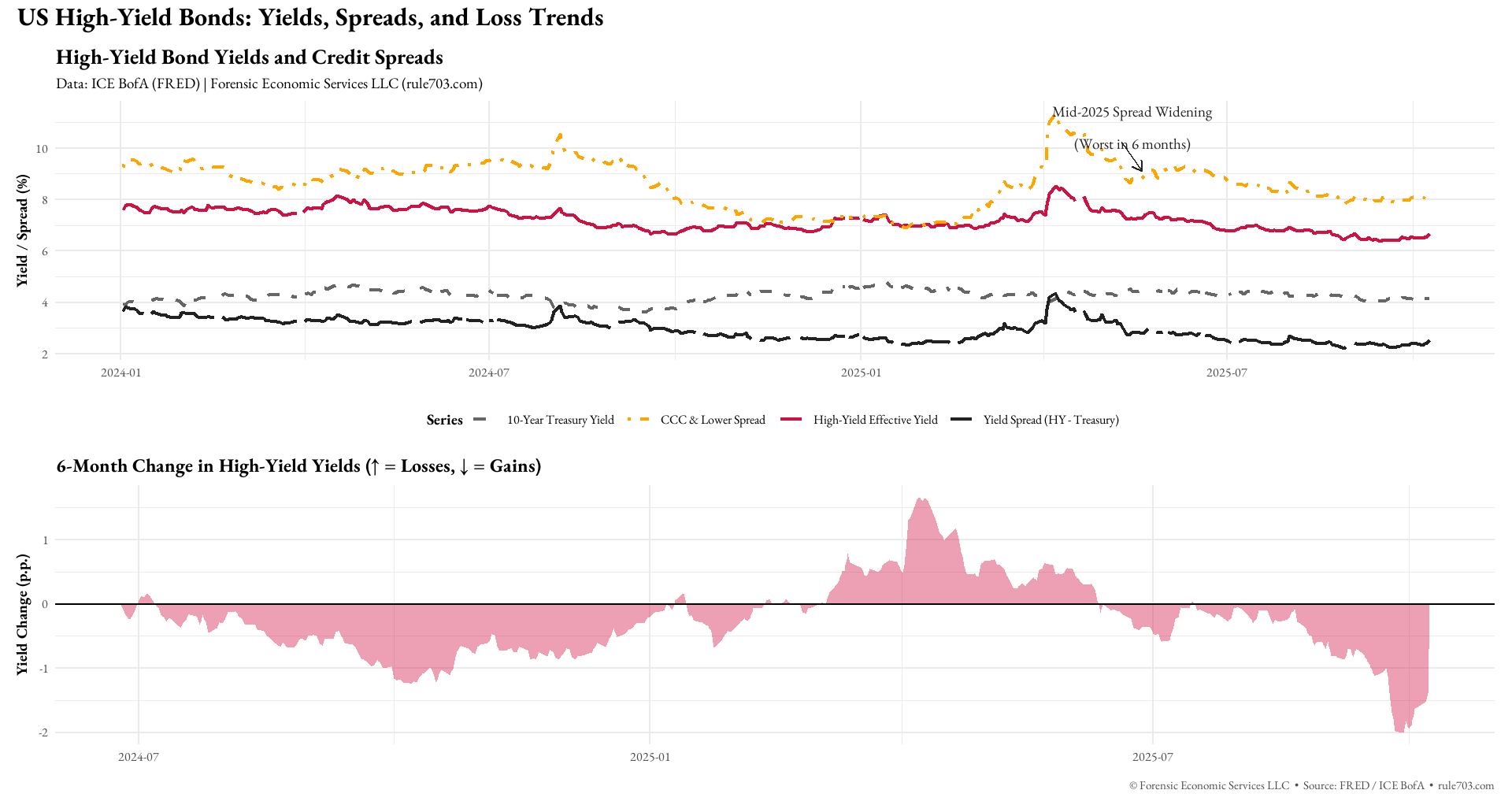

This chart shows how interest rates on “junk” (high-yield) bonds — loans to riskier companies — jumped sharply in mid-2025. That spike means investors suddenly demanded higher returns to lend money to those firms — a sign of growing fear about defaults or slower growth.

The orange line shows the riskiest bonds (CCC-rated). Those yields shot up above 10%.

The red line shows the broader high-yield market, which also rose.

The black line shows the spread — the extra interest junk bonds pay over safe U.S. Treasuries. When that number widens, it means stress is rising.

In short:

-Borrowing got more expensive for riskier companies.

-Investors got cautious.

-Markets were flashing warning lights about credit risk.

by forensiceconomics

1 Comment

Why was there a little peak around April?